We now use the very popular MoneySoft Payroll Manager bureau software which is HMRC accredited, and

is ready for the new Real Time Information (RTI) requirements from 2013.

Subsidised to bookkeeping clients/ limited company clients

The payroll service is subsidised to those clients who use our bookkeeping service and/or limited company clients.

The subsidised offer includes up to two monthly paid employees. More than two employees per month will incur an extra charge of the current rate per payslip as mentioned below.

Subsidised payrolls for limited company clients who do their own bookkeeping will be subject to setting up a monthly standing order for fees. If the client cancels

the accounting services agreement before the year end has been completed, billed for and paid, then any monies paid on account by standing order will be subject

to a charge for payroll fees to date calculated as per the rates mentioned below, and any remaining advance payments will be refunded subject to any other further work carried out

as per the client's instructions and not yet paid.

Weekly payrolls are available but will be subject to the normal payroll service charges as mentioned below.

What's included

The service includes periodic payslips (weekly/monthly) and period summaries. The RTI (Employer's Payroll Summary) will be emailed to you as soon as it is completed and the rest of the reports

will be sent by post to you.

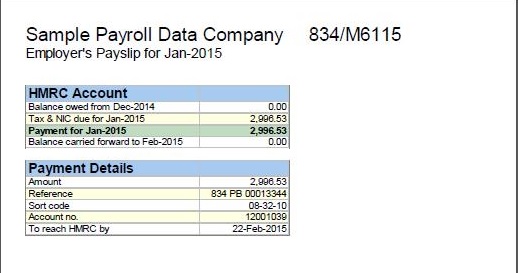

PAYE/NIC summarised totals (P32) for each period and the year to date will also be prepared each pay period so that you always know how much

is due to pay HMRC. We also email you a P30 (Employer's payslip) each month which reminds you how much you need to send the Revenue.

All RTI reports including online submission to HMRC, and printed P60s for your employees.

These can all be sent to you by post/email. We can register you for electronic filing if not already registered.

The service also includes free administration of auto enrolment routines for NEST Pensions. If you use a different pension provider then we can provide the required csv file for you to upload to your pension provider.