Incorporated Financial Accountant

01255 242311

|

Philip M Collis, FFA

Incorporated Financial Accountant 01255 242311 |

|

|

|

|

|

|

MLR 2007 / IR35 and self employment / Value Added Tax (VAT) / About the IFA / Useful Articles / search this site / download brochure / Contact

We all need to keep financial records for various reasons. If you fill in a tax return,

VAT return or claim benefits or tax credits, there are some special rules.

Click here to load the HM Revenue and Customs guide to record keeping.

There are various ways to pay including by Direct Debit, internet/telephone banking, Faster Payments or debit and credit cards over the internet. You can also pay by cheque at a bank or building society using a Bank Giro paying-in slip which should be obtained from HMRC (these are pre-printed with your unique details). Since some of these methods can take a little time to set up, you should choose which method you want to use, and set it up, well in advance of the filing and payment deadline.

|

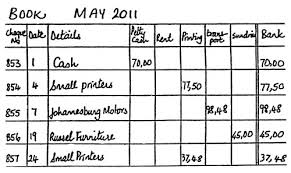

We can keep a full set of manual books if required, although it would be far more cost

effective to keep records on a computer with appropriate accounting software. Manual books may include books of Prime Entry such as Purchases Book, Sales Book, Cash Book, Wages Book, Petty Cash Book and Journal. In addition it would be necessary to post periodic totals from these books to the ledgers, which include Sales Ledger, Purchase Ledger and Nominal Ledger. Note - this may change with the governments introduction of MTD ITSA in 2024 unless exempt. |

Bookkeeping arrangements; (clients are advised not to attempt using accounting software unless qualified to tb)

In all cases for the following I would need a csv or Excel (xls) format bank feed of your business account each month